By Lisa Hanke, Director, Regulatory Engagement, EcoEngineers

On June 13, 2025, the U.S. Environmental Protection Agency (USEPA) released the proposed Renewable Volume Obligations (RVOs) under the Renewable Fuel Standard (RFS) for 2026 and 2027, with a partial waiver of the 2025 cellulosic biofuel volume requirement, and other changes. Stakeholders are invited to send comments on or before August 8, 2025.

The USEPA’s proposal reflects a deliberate approach—one that aims to support domestic biofuel and feedstock production while discouraging imports and clarifying compliance expectations.

EcoEngineers is closely tracking the USEPA’s RFS rulemaking process and how it impacts renewable fuel producers and markets. Our team of experts is here to help you navigate these proposed changes through tailored education, stakeholder engagement, regulatory advisory, and compliance management services. Whether you’re a fuel producer, importer, or obligated party, we’re ready to support your success in this dynamic regulatory environment.

Below, we break down the key elements of the proposal.

Volume Targets: New Growth, New Metrics

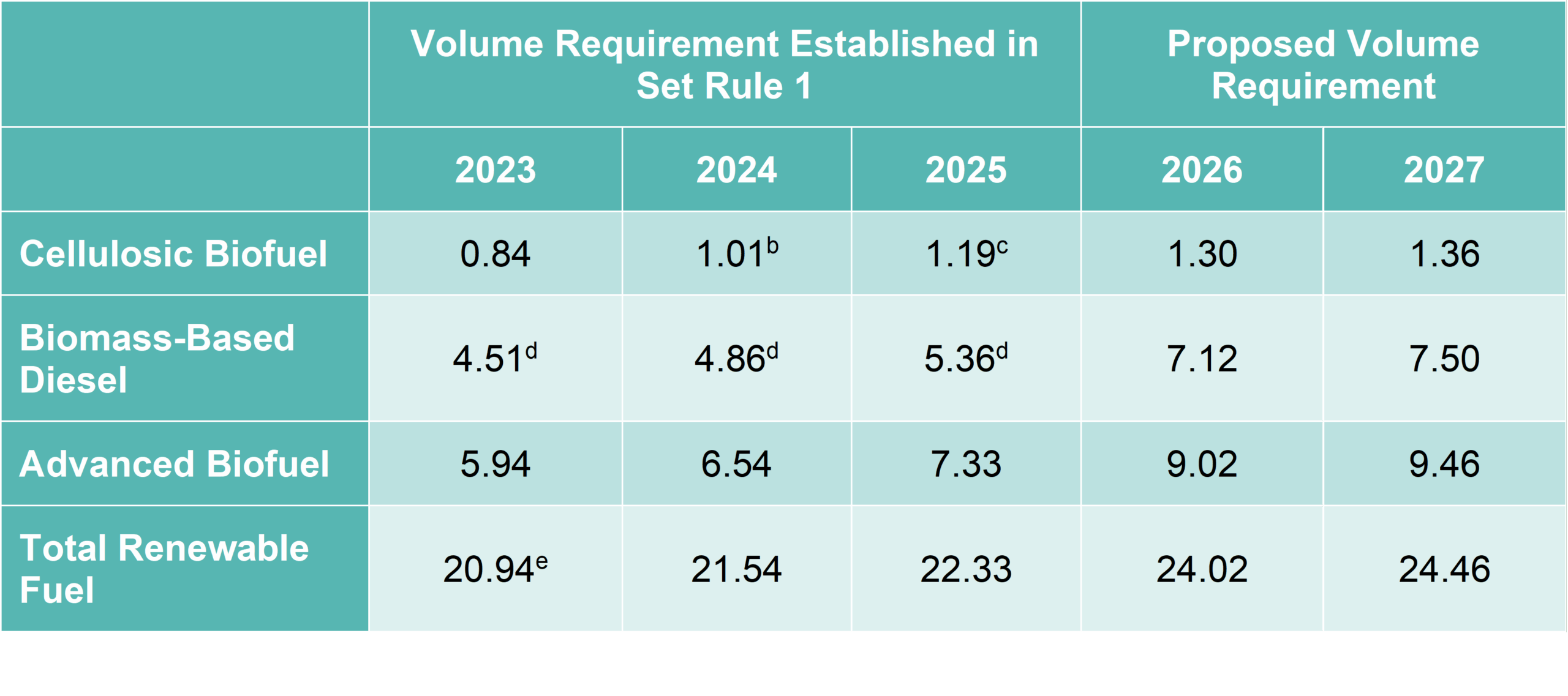

The USEPA proposes to express biomass-based diesel targets in Renewable Identification Numbers (RINs) rather than gallons, using a conversion factor of 1.6 RINs per gallon. While this shift aligns biomass-based diesel with other fuel categories, the overall volume growth is modest (Table 1). Cellulosic biofuel volumes show only slight increases from 2025 to 2027 and remain below the original 2025 targets. Implied conventional renewable fuel targets remain flat at 15 billion gallons, while total renewable fuel volumes inch upward from 22.33 billion RINs in 2025 to 24.46 billion in 2027.

Table 1: RFS Volume Requirements for 2023-2027 (Billion RINs)a

Source: USEPA

Notes:

a One RIN is equivalent to one ethanol-equivalent gallon of renewable fuel.

b USEPA originally established a cellulosic biofuel volume requirement of 1.09 billion gallons for 2024 in the Set 1 Rule. USEPA subsequently reduced this volume requirement to 1.01 billion RINs in a separate action.

c USEPA originally established a cellulosic biofuel volume requirement of 1.38 billion gallons for 2025 in the Set 1 Rule. The USEPA is proposing to reduce this volume requirement to 1.19 billion RINs in this action.

d Through 2025, the BBD volume requirement was established in physical gallons rather than RINs. The USEPA is proposing to specify the BBD volume requirement in RINs, consistent with the other three renewable fuel categories, rather than physical gallons. For the sake of comparison, the USEPA converted the BBD volume requirements for 2023–2025 from physical gallons to RINs using the BBD conversion factor in 40 CFR 80.1405(c) of 1.6 RINs per gallon.

e The total renewable fuel volume requirement for 2023 does not include the 0.25 billion RIN supplemental standard.

Finalized 2024 Cellulosic Biofuel Volume Partial Waiver

The USEPA finalized a partial waiver for the 2024 cellulosic biofuel requirement, reducing the target from 1.38 billion to 1.19 billion RINs. This follows a similar adjustment for 2025 and reflects market saturation and ongoing production delays in the cellulosic sector.

Key Policy Changes and Clarifications

- Import RIN Reduction: To reduce reliance on foreign feedstocks and mitigate fraud risks, the USEPA proposes a 50% reduction in RIN value for imported renewable fuels and fuels made from foreign feedstocks. This change would apply starting in 2026 and includes new reporting and liability provisions for importers and domestic producers.

- Removal of Renewable Electricity: The USEPA proposes to remove renewable electricity as a qualifying fuel under the RFS, citing its limited role in displacing fossil fuels in transportation.

- Adjusted Equivalence Values: To better reflect fossil-derived hydrogen content, the USEPA proposes new equivalence values: 1.6 for renewable diesel and jet fuel, and 1.4 for renewable naphtha. Producers may still apply for alternative values.

- RIN Generation Timing: The proposal clarifies when RINs must be generated, depending on the fuel type and production location. For gaseous fuels like renewable natural gas (RNG) and compressed or liquified natural gas (CNG/LNG), RINs must be generated within five business days of meeting all requirements.

- Biodiesel Use Restrictions: Reinforcing the program’s focus on transportation fuels by proposing RINs cannot be generated for pure or neat biodiesel used for process heat or power generation.

Expanding and Refining Fuel Pathways

The USEPA proposes to add new pathways for naphtha and liquefied petroleum gas (LPG) derived from biogenic waste oils, and to clarify existing pathways with more precise language. Two new biointermediates—activated sludge and converted oils—are also proposed for inclusion.

Compliance and Oversight Enhancements

- Small Refinery Reporting: Even if exempt from RFS obligations, small refineries would still be required to file annual compliance reports and address any carried-over deficits.

- Auditor Registration: Third-party auditors would only need to renew their registration every two years instead of annually, reducing administrative burden.

- Engineering Review Site Visits: Site visits must occur within six months of submitting a registration request to ensure accuracy and relevance.

Biogas Regulatory Reform Updates

The USEPA also proposes to allow biogas batches to be defined by calendar month and to expand approved measurement and calibration methods for RNG and biogas. These updates aim to align regulatory requirements with industry practices and improve data accuracy.

About the Expert

Lisa Hanke, director, regulatory engagement at EcoEngineers, has worked in the renewable fuels space for more than 18 years. Ms. Hanke led government relations and regulatory outreach in the U.S. Europe and Canada. She has extensive experience with the Renewable Fuel Standard (RFS), California’s Low Carbon Fuel Standard (LCFS), the Renewable Energy Directive (RED), the Renewable Transport Fuel Obligation (RTFO) and she closely follows the Canadian Clean Fuel Regulation (CFR) and a variety of other carbon programs across the world. Ms. Hanke was responsible for evaluations of policy, regulatory engagement, compliance, and life-cycle analysis (LCA). She has also sat on the board of directors for the Advanced Biofuels Association of Canada, the Advanced Biofuels Business Council, and the Leaders of Sustainable Biofuels.

For more information about EcoEngineers’ Regulatory Engagement and/or Compliance Management services and capabilities, contact:

Lisa Hanke, Director, Regulatory Engagement | lhanke@ecoengineers.us

About EcoEngineers

EcoEngineers, an LRQA company, is a consulting, auditing, and advisory firm exclusively focused on the energy transition and decarbonization. From innovation to impact, EcoEngineers helps its clients navigate the disruption caused by carbon emissions and climate change. Its team of engineers, scientists, auditors, consultants, and researchers live and work at the intersection of low-carbon fuel policy, innovative technologies, and the carbon marketplace. For more information, visit www.ecoengineers.us.

More EcoInsights

20 November 2025

Carbon Counts: Exploring Optionality in Environmental Markets

19 November 2025