By Lisa Hanke, Regulatory Engagement Director

EcoEngineers

The United States (U.S.) and the United Kingdom (UK) recently announced a new trade deal, which is a significant milestone in international trade relations. Among its many provisions, the agreement aims to open new avenues for U.S. exports of ethanol, including the removal of the longstanding 19% tariff on U.S. ethanol, granting duty-free access to the UK market for the first time, representing an opportunity for U.S. ethanol producers to expand their market reach and increase exports.

Specifically, the U.S.-UK trade deal aims to enhance market access for various goods, including chemicals, machinery, beef, automobiles, steel, and aluminum. The agreement includes provisions for $700 million in additional ethanol exports to the UK, which already is a significant importer of U.S. ethanol. According to data published by the U.S. Department of Agriculture (USDA) Foreign Agricultural Service (FAS), nearly 13% of U.S. ethanol exports were exported to the UK last year. In terms of volumes, U.S. ethanol exports to the UK reached approximately 243.84 million gallons in 2024, representing an estimated value of $535.12 million.

As the U.S. ethanol industry prepares to capitalize on these opportunities, understanding and complying with the UK’s Renewable Transport Fuel Obligation (RTFO) becomes paramount.

Understanding the RTFO

U.S. ethanol producers seeking to enter the UK transportation market must comply with the RTFO, which requires that fuels meet specific sustainability and greenhouse gas (GHG) emission reduction criteria. RTFO compliance is necessary if U.S. ethanol is intended for use in the UK transportation sector—either as a direct blend in gasoline (currently up to 10%) or as a feedstock for producing ethyl tert-butyl ether (ETBE), which is used as an oxygenate or octane enhancer in gasoline.

Under the main RTFO obligation, all types of feedstocks are accepted, including food-based crops such as sugar beet, sugarcane, and corn. However, their use is subject to strict sustainability criteria, and there is a cap on the volume of crop-based biofuels that can be counted toward compliance. This cap, which began at 4% of a supplier’s total fuel supply, is set to decrease to 3% by 2026 and will fall further to 2% by 2032. These limitations are designed to mitigate indirect land-use change (iLUC) and ensure environmental integrity.

U.S. Producers Must Comply

For U.S. ethanol producers, compliance with the RTFO is not optional—it is a prerequisite for market access. The RTFO requires that ethanol achieve a minimum of 55% GHG savings for facilities operating on or before October 5, 2015, and 65% if the facility began operating after this date. Additionally, sustainability data must be verified by an approved third-party verifier before Renewable Transport Fuel Certificates (RTFCs) are issued. It is worth noting that the buy-out price for the main obligation is £0.50 (US$0.67) per liter, with ethanol falling under the main RTFO obligation. The buy-out price offers an alternative method of compliance; instead of delivering a targeted volume of renewable fuel, a fuel supplier may opt to just pay this buy-out price.

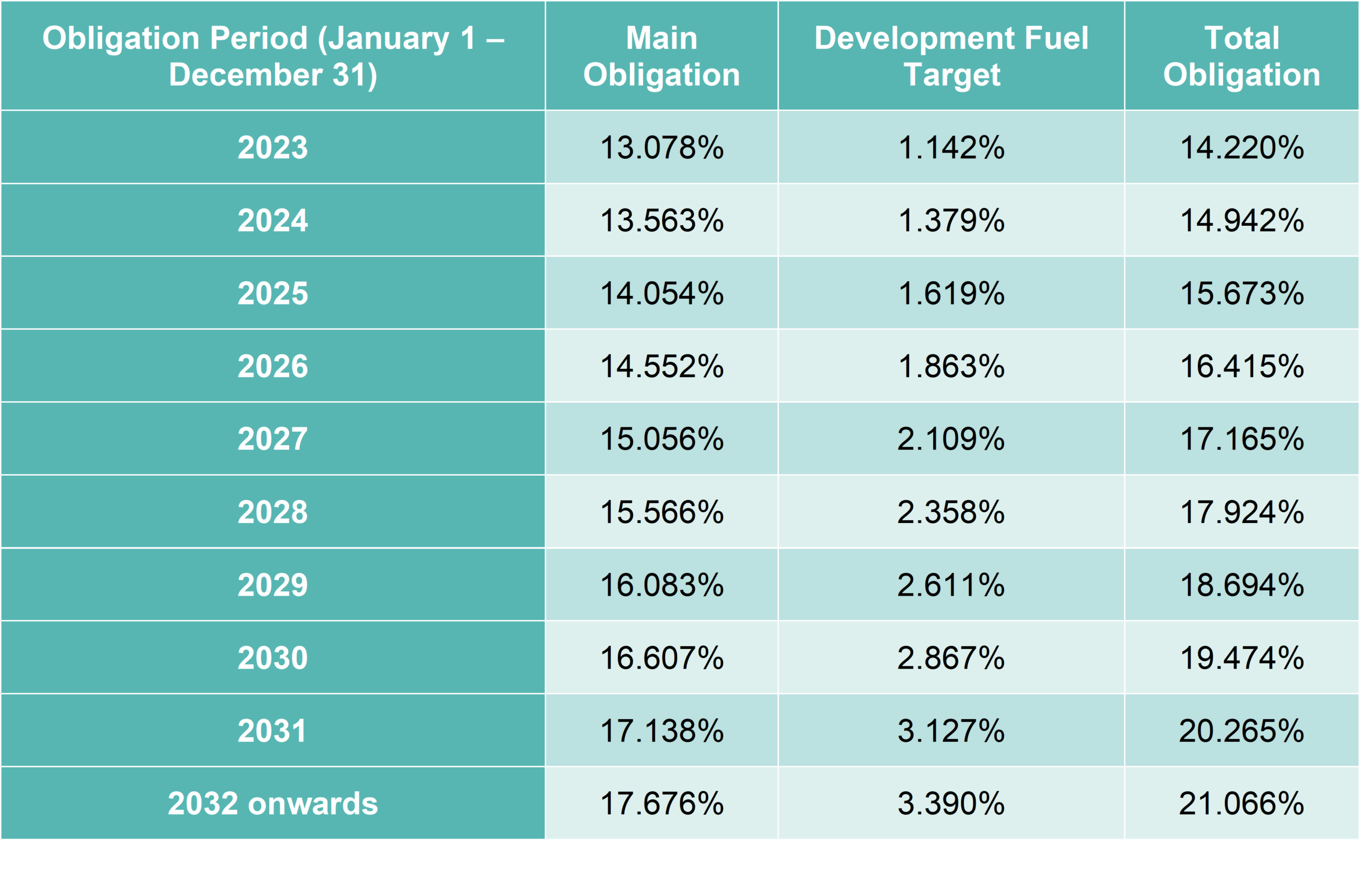

Currently, RTFCs fetch a value of approximately £0.25 (US$0.33) per about one liter (or .26 US gallons) of fuel. That value may be twice as much if advanced feedstock contributing towards the “Development Fuel Target” (e.g., agricultural wastes such as straw, husks, shells, and similar byproducts, food-industry wastes and byproducts like distiller’s grains or other fermentation residues or food waste, or lignocellulosic materials) is used (Figure 1).

Figure 1: RTFO Compliance Trajectory

Source: UK Department of Transportation

Strategic Considerations for Exporters

The RFTO’s requirements are rigorous and multifaceted. U.S. ethanol producers looking to capitalize on the new trade deal must be prepared to:

- Quantify and Verify GHG Reductions: This involves a detailed life-cycle analysis (LCA) of emissions from feedstock cultivation through fuel production and transport.

- Demonstrate Sustainability: Producers must show that their feedstocks are sourced responsibly and meet stringent land use and biodiversity criteria.

- Maintain Traceability: The RTFO requires a mass balance system to track the flow of sustainable material through process technologies and the supply chain.

- Undergo Third-Party Verification: Only fuels certified by recognized voluntary schemes or verified by approved auditors are eligible for RTFCs.

These requirements can be challenging for ethanol producers unfamiliar with the UK’s regulatory environment or those who have not previously exported to markets with similar standards.

Why RTFO Compliance Matters

The U.S.-UK trade deal can raise the stakes for regulatory missteps. Non-compliance can result in delayed market entry, financial penalties, or reputational damage. For this reason, it is recommended that ethanol producers turn to specialized compliance advisors who can help:

- Interpret and apply RTFO requirements to their operations.

- Prepare documentation and data for verification.

- Identify opportunities to improve GHG performance and sustainability metrics.

- Navigate the certification process efficiently and accurately.

Such support is especially valuable for companies scaling up exports or entering the UK market for the first time. It ensures that compliance is not just a box-checking exercise but a strategic enabler of market access and long-term competitiveness.

Summary

The RFTO is a sophisticated regulatory framework that demands careful attention to detail and a proactive approach to compliance strategy. As the global low-carbon fuel market evolves, the ability to navigate such frameworks will become a core competency for exporters. Whether through internal teams or external advisors, investing in compliance readiness is not just prudent—it’s essential for unlocking the full potential of international trade opportunities.

About the Expert

Lisa Hanke, regulatory engagement director at EcoEngineers, has worked in the renewable fuels space for more than 15 years. Ms. Hanke led government relations and regulatory outreach in the U.S. and Europe. She has extensive experience with the Renewable Fuel Standard (RFS), California’s Low Carbon Fuel Standard (LCFS), and she closely follows the Canadian Clean Fuel Standard (CFS) and a variety of other carbon programs across the world. Ms. Hanke is responsible for evaluations of policy, regulatory engagement, compliance, and life-cycle analysis (LCA). She has also sat on the board of directors for the Advanced Biofuels Association of Canada, the Advanced Biofuels Business Council, and the Leaders of Sustainable Biofuels.

For more information about EcoEngineers’ Regulatory Engagement and/or Compliance Management services and capabilities, contact:

Lisa Hanke, Director of Regulatory Engagement | lhanke@ecoengineers.us

About EcoEngineers

EcoEngineers, an LRQA company, is a consulting, auditing, and advisory firm exclusively focused on the energy transition and decarbonization. From innovation to impact, EcoEngineers helps its clients navigate the disruption caused by carbon emissions and climate change. Its team of engineers, scientists, auditors, consultants, and researchers live and work at the intersection of low-carbon fuel policy, innovative technologies, and the carbon marketplace. For more information, visit www.ecoengineers.us.

More EcoInsights

15 January 2026