Global shipping is on the verge of a major policy shift. The International Maritime Organization (IMO) is set to vote this month on its draft Net-Zero Framework, a landmark proposal that would introduce a new fuel standard for ships and establish a global pricing mechanism for greenhouse gas (GHG) emissions. This Framework, first advanced during its 83rd session of the Marine Environment Protection Committee (MEPC 83) in April 2025, presents an opportunity for adopting and scaling low- and zero-carbon fuels, creating new market and innovation incentives for both fuel producers and shipowners.

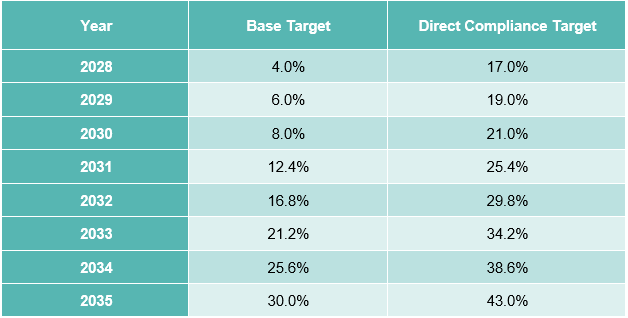

The Framework sets out ambitious emissions reduction targets that increase quickly over time, reflecting the urgency of aligning the maritime sector with global climate goals.

Beginning with modest reductions, the Framework escalates requirements sharply through the 2030s and 2040s with the target reductions relative to a 2008 reference GHG emissions level of 93.3 grams of carbon dioxide-equivalent per megajoule (g CO2eq/MJ) (well-to-wake). The use of both a Base Target and a stricter Direct Compliance Target ensures that shipowners steadily reduce emissions year by year. This rapid progression is designed to stimulate early investment in low- and zero-carbon fuels, encourage fleet innovation, and minimize the risk of delayed action that could jeopardize long-term climate commitments. The Framework also establishes the Net-Zero Fund, which will be financed by ship operators who elect to pay the CO2 price to buy compliance units instead of utilizing low-carbon fuels. The Net-Zero Fund will be distributed to those who deploy net-zero or near-net-zero technologies, including fuels with emissions of less than 19 g CO2/MJ.

Table 1: Target Emissions Reduction Levels from an IMO Reference Marine Fuel GHG Emissions Level[1]

[1] IMO Circular Letter No.5005 Draft Revised MARPOL Annex VI

The Framework will be integrated into a new Chapter 5 of Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL), which addresses the prevention of air pollution from ships. Following approval, draft amendments to MARPOL Annex VI will be circulated to IMO Member States. Key milestones in the implementation process include:

- October 14, 2025 (MEPC/ES.2): Adoption of amendments during the Marine Environment Protection Committee

- Spring 2026 (MEPC 84): Approval of detailed implementation guidelines

- 2027: Expected entry into force, 16 months after adoption, consistent with MARPOL procedures

Challenges and Considerations

Global Implementation

While the Framework has the potential to cover approximately 97% of global maritime activity, its universal adoption and enforcement remain uncertain. Opposition from IMO Member States such as the United States (U.S.), Saudi Arabia, Russia, Malaysia, Indonesia, and Venezuela could limit its impact. Despite these uncertainties, the Framework signals strong international support for low- and zero-carbon fuels, offering a growth opportunity even in regions with slower adoption.

Development of Guidelines

As with all new climate policies and programs, the devil is in the details. The formal adoption of the Framework could be a critical step forward; however, the development of implementation guidelines will provide the industry with necessary details on how to participate and best monetize this program. Elements such as allowed fuel production feedstocks, life-cycle analysis (LCA) methodology, compliance schedules, traceability requirements, and independent verification are key to the successful uptake of the Framework.

CO2-Based Penalties Drive Low-Carbon Fuel Adoption

Penalties remain a key mechanism for stimulating the adoption of renewable and low-carbon fuels. The Framework introduces a two-tiered penalty system based on annual emissions targets, a “Base Level” and a “Direct Compliance” level, that increase in stringency over time. Shipowners ultimately bear financial responsibility for non-compliance, emphasizing the importance of proactive emissions management. The draft Framework text indicates penalty values of $100/tonne CO2-eq for Direct Compliance units, and an additional $380/tonne CO2-eq for Base Level units. These penalty structures, combined with financial incentives, create a concrete opportunity for the low-carbon fuel suppliers to play a key role in decarbonizing the maritime shipping industry.

Expanding Pathways to Maritime Decarbonization

While the Framework’s CO2-based penalties are designed to accelerate the adoption of low- and zero-carbon fuels, it is important to recognize that fuel switching is only one part of a broader decarbonization strategy. Significant GHG reductions will also come from investments in ship redesign, slow steaming, optimized logistics and routing, improved at-dock practices, and advanced engine technologies. These measures, often referred to as “operational and technical improvements,” can deliver substantial emissions reductions and cost savings, especially when combined with low-carbon fuels. The Framework is expected to incentivize these approaches as shipowners seek the most effective pathways to compliance and cost management.

Policy Alignment with the European Union (EU) and the U.S.

The Framework and the EU’s decarbonization programs share a common objective of reducing maritime GHG emissions, but their scope and structure differ significantly. The Framework, once adopted, will apply globally, whereas the EU’s FuelEU Maritime initiative and Emissions Trading System (ETS) primarily regulate activity in European waters and on 50% of voyages to and from EU ports. The EU has already moved forward with binding requirements starting in 2025. For shipowners and fuel suppliers, this means navigating two systems with differing methodologies, fuel eligibility criteria, and compliance mechanisms. At the same time, the interaction between the two frameworks could create efficiencies, reinforcing momentum toward low- and zero-carbon fuels worldwide.

Differences in the programs will require companies to implement robust and adaptable monitoring and reporting systems. A significant potential difference concerning feedstock eligibility is that the EU excludes crop-based feedstocks and materials that can be used for food and for animal feed, whereas the Framework might permit them. This could provide an opportunity for fuels that meet the EU’s requirements to generate surplus compliance units under the Framework, potentially unlocking additional financial incentives.

Meanwhile, there is some movement in the U.S. primarily through the proposal of the Clean Shipping Act of 2025, which aims to eliminate GHG emissions from ocean shipping companies operating in the U.S. The Act directs the Environmental Protection Agency (EPA) to establish progressively stricter carbon intensity standards for marine fuels, beginning with a 30% GHG reduction by 2030 and leading to 100% by 2050. There is also a proposed bill to expand the Renewable Fuel Standard (RFS) to include ocean-going vessels. This change would enable vessel operators to receive credits, potentially creating revenue streams and narrowing the cost gap between renewable and conventional fuels.

The U.S. is certainly lagging the IMO and the EU in maritime decarbonization efforts; however, the recent proposed legislation represents a promising step forward. These measures could signal a growing interest in reducing GHG emissions from U.S. shipping, creating an additional opportunity for low-carbon fuel producers.

Conclusion

Approval of the IMO Net-Zero Framework would represent a crucial step toward decarbonizing global shipping. Companies that can adapt quickly, implement comprehensive monitoring systems, and strategically leverage incentives will be best positioned to capitalize on the opportunity presented by the growing low- and zero-carbon fuel market.

The next three years will be pivotal for the maritime sector, not only for regulatory compliance but also for accelerating the transition to a cleaner, low-carbon future on the world’s oceans.

Contact EcoEngineers to better understand the regulations, your fuel options, and their impact on your carbon intensity score at clientservices@ecoengineers.us.