A Renewable Fuels Entrepreneur Checklist: 10 Critical Factors for Project Success

Find out what early-stage renewable fuel, biochemicals, hydrogen, and CCUS project developers need to know to avoid pitfalls on their path to commercialization.

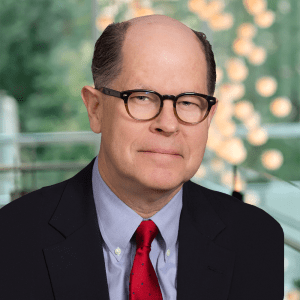

By Ed Arnold, Director, Asset Development

Far too many entrepreneurial renewable fuels, clean hydrogen, biochemical, and carbon capture, utilization, and sequestration (CCUS) firms never pass the finish line. Shifting markets, recessions, evolving and complex regulations, hiring managers with the appropriate experience, finding patient investors, and the difficulties associated with developing projects based on cutting-edge, unproven process technology present significant challenges.

Looking back upon the renewable fuels projects I have reviewed over the last 20 years, I see considerable repetition regarding issues that are often the cause of stumbles. My summary of the top 10 reasons for failure or lengthy delays, along with some suggestions for risk mitigation, are summarized below.

- Underestimating Capital Cost (CapEx) and Operating Cost (OpEx)

- Poor CapEx estimations are a common error for renewable fuel entrepreneurs. Some will start with a maximum project cost target that will still allow them to achieve an attractive return on investment (ROI) and assume that innovation, hard bargaining, excellent project management, and hard work will get them to that number. In addition, I have seen absolute faith in project capital cost estimates delivered by process technology providers or engineering firms delivering early-stage work — both of which have the incentive to lowball total installed cost estimates for projects.

- This issue can usually be avoided by comparing the planned project to reasonable estimates of actual final costs for similar projects and using established total installed cost curves for all major project items, something that independent, experienced consultants can help entrepreneurs develop. Although they have downsides, asking for lump sum turnkey (LSTK) bids is another approach that can be used to firm up realistic total installed cost estimates.

- Additionally, underestimating OpEx occurs frequently with new plants and novel processes. Common culprits are underestimating catalyst costs, operational labor requirements, or facility maintenance costs.

- The solution: Engage experts early in the feasibility stage who have run similar facilities to get a dose of reality injected into the cost estimates.

- Skipping Process Demonstration

- For a new process technology, it’s essential to move from the pilot stage to an intermediate process demonstration stage before scaling to a commercial-scale facility. Otherwise, your first commercial run usually becomes a costly process development run. All established renewable fuel process development firms know this.

- The record of entrepreneurial renewable fuels business development history is littered with the memories of firms that thought they could go directly from pilot plant runs to successful commercial design and then complete a quick start-up. This behavior is sometimes reinforced by their engineering, procurement, and construction (EPC) firm. Every entrepreneur should review the long history of successful and unsuccessful new process technology development for renewable fuel production. They also need to understand that process development and process scale-up are two different subjects.

- Early-Stage Vetting of Carbon Intensity (CI)

- Too many renewable fuels entrepreneurs delay having an expert run the correct Greenhouse gases, Regulated Emissions, and Energy use in Transportation (GREET) model(s) with the correct inputs early in their business development effort, only to find out that their actual CI is quite a bit higher than they originally expected. The relatively low cost of completing a few essential life-cycle assessment (LCA) runs is minimal compared to the millions of dollars that could be lost.

- Supply and Offtake Agreements

- I often see gaps between feedstock supply and offtake agreements that predict declining margins in the future. This can be and should be avoided. Entrepreneurs should engage experts who understand the intricacies of price basis indexes and who can provide defendable, scenario-based feedstock cost and product value price forecasts, as well as suggestions for hedging against margin shrinkage.

- In addition, I have seen offtake agreements with durations of two to five years, when the payback for the investment will be much longer. Their ultimate lenders will not find that attractive.

- Underestimating Project and Process Timelines

- Full project schedules are often underestimated, sometimes by years. Get advice from a knowledgeable expert at an early stage in the project. Understanding the time requirements for permitting, environmental studies, geotechnical work, site preparation, and the local availability of all required construction skill sets is essential for developing a realistic estimate.

- A seasoned project development professional will also be able to help entrepreneurs de-risk their project schedules.

- Underestimating Production Volumes

- Project developers often use optimistic projections of production volumes in their financial models and promotional materials. These volumes often never come to fruition.

- The solution is to confer with process design and development experts and to base process yield expectations based on longer-term demonstration plant runs and rigorous heat and material balances.

- Long-Duration Testing for Corrosion and Fouling

- One of the typical problems for renewable fuels projects is that the project developers may not understand that high-impact fouling and corrosion issues may not show up for many weeks or even months after a first commercial demonstration test run has begun.

- A demonstration run that lasts a week or two will usually not answer all the outstanding questions. Have an expert help set up and monitor your run. This will pay dividends in the long run.

- Process Development, Project Management, Facility Management, and Operations Management

- Owners should select process, project, facility, and operations managers that have proven, hands-on experience in the field of work. Proven experience with the core process technologies that will be used in the current project is a plus. Proven ability to select successful operations, maintenance, health, safety, environmental (HS&E), compliance, and planning supervisors is a necessity. If first-of-a-kind process technology is to be used, experience with going through a first-of-a-kind process start-up is a plus.

- Understanding All Regulatory and Permitting Requirements

- Too often, I have seen an owner get very close to a start-up and then suddenly realize that they could not sell their product to the intended parties or claim essential credits because of a lack of required approvals, inspections, reviews, etc. These planning oversights are sometimes the result of bad advice and sometimes it is simply an error of omission. Owners should consult with appropriate experts at an early stage in the project planning process to ensure a thorough review of all regulatory and permitting requirements is vetted and completed.

- Material Balance Issues

- A material balance is a quantitative accounting for all mass entering and leaving a process system, showing that the total weight entering a plant comes very close to the total weight going out. Building this balance is a method for ensuring that all products produced from a process system are accounted for.

- I too often encounter or hear of a process development entrepreneur who, sometime during their first long-term demonstration run or first commercial-scale process run, is surprised by the behavior of a previously unaccounted-for-byproduct in their process.

- The consequences are often significant. Some examples are (a) the discovery of significant fouling in or after a reactor or a process heat exchanger, (b) the underestimation of solvent, adsorbent, or catalyst consumption rates, or (c) the discovery that a compound, previously unaccounted for and eventually determined to be toxic, explosive, or a long-duration greenhouse gas (GHG), is off-gassing from a collected major liquid product, or a solid-phase reaction byproduct.

- Many of these issues resulted in unfortunate consequences for the entrepreneurs. Nearly all could have been avoided if the process/project developers had invested in the proper measurement-enabling equipment and had taken the time to perform rigorous material balances during their pilot plant or process demonstration runs. However, for some entrepreneurs, this level of detail is often viewed as optional, too expensive, or simply unnecessary. For experienced process developers, closing material balances is a must.

EcoEngineers: Your End-to-End Guide

In summary, setting project costs, schedules, and performance expectations and making decisions based on the knowledge of individuals who have proven experience in the renewable fuels industry will prevent costly mistakes and delays. Choosing experienced personnel who know how to manage your entire EPC project phase, selecting and training your operations staff, and then starting up and operating your facility, will also be a wise investment.

This is why engaging proven regulatory and permitting experts like those at EcoEngineers early in the project cycle, to help guide you through the regulatory and permitting jungle, can save you millions in lost revenue.

We provide valuable services and capabilities to renewable fuels start-up companies with experience-based guidance to help them navigate the challenges of the industry. Whether it’s comparing project costs to realistic estimates or evaluating the feasibility of novel process technology and communicating that to your investors, we can help.

For more information about our Asset Development services, please contact:

Ed Arnold, Director, Asset Development | earnold@ecoengineers.us