Washington Cap-and-Invest and Clean Fuel Standard Programs

By Stephanie Gee, Verification Engineer

In January 2023, the Washington Department of Ecology (DoE) began implementing the cap-and-invest program to achieve the greenhouse gas (GHG) limits set in state law. At the same time this was passed, Washington also created the Clean Fuel Standard (CFS) to specifically curb transportation emissions. Navigating these two market-based policies may be challenging, especially for fuel suppliers that are required to participate in both, but these programs may also be an opportunity for low-carbon technologies and clean fuel suppliers.

Washington’s Cap-and-Invest Program: What is It?

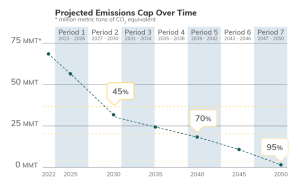

Under the cap-and-invest program, most businesses that emit more than 25,000 metric tons of carbon dioxide (CO2) equivalent (MT CO2e) annually must obtain allowances equal to their covered GHG emissions. The covered emissions are determined from businesses’ GHG reports to the Washington DoE, which are due by March 31 for the previous calendar year. Businesses can purchase allowances at quarterly DoE-hosted auctions, with the first auction held on February 28, 2023.

These allowances can then be purchased or sold on secondary markets. In addition, some businesses will be issued no-cost allowances: emissions-intensive, trade-exposed industries (EITEs), natural gas utilities, and electric utilities. The first deadline for businesses to submit their emissions allowances and/or offset credits is November 1, 2024, to cover 30% of their 2023 emissions. Any business that can rapidly decarbonize its technology during the four-year compliance period would then be able to sell excess allowances that are not needed for compliance.

Inside Washington’s Clean Fuel Standard

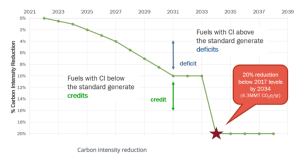

The Washington CFS is designed to work in tandem with the cap-and-invest program and the design structure is similar to California’s Low-Carbon Fuel Standard (LCFS) program. The Washington CFS requires fuel suppliers to reduce the carbon intensity (CI) of transportation fuels to 20% below 2017 levels by 2034. Some of the major exemptions from this program are aviation, marine, railroad locomotives, and military.

Fuel suppliers may apply for a CI that is already approved by California’s Air Resources Board (CARB) or Oregon’s Department of Environmental Quality (DEQ), but it must be adjusted using Washington’s Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) model. Clean fuels with CI scores below the standard will generate credits that can be sold and fuels with CI scores above the standard will generate deficits that will need to be covered by purchasing credits.

EcoEngineers Is Here to Help

EcoEngineers is a consulting, auditing, and advisory firm with an exclusive focus on the energy transition. From innovation to impact, Eco helps its clients navigate the disruption caused by carbon emissions and climate change. Eco helps organizations stay informed, measure emissions, make investment decisions, maintain compliance, and manage data through the lens of carbon accounting. Its team of engineers, scientists, auditors, consultants, and researchers live and work at the intersection of low-carbon fuel policy, innovative technologies, and the carbon marketplace. Eco was established in 2009 to steer low-carbon fuel producers through the complexities of emerging energy regulations in the United States. Today, Eco’s global team is shaping the response to climate change by advising businesses across the energy transition.

For more information about the State of Washington’s cap-and-invest and Clean Fuel Standard programs, please contact us at clientservices@ecoengineers.us.