The following is an article originally published in the November/December 2023 issue of Steel Times International.

Europe Requires Imported Steel and Iron to Report Carbon Emissions

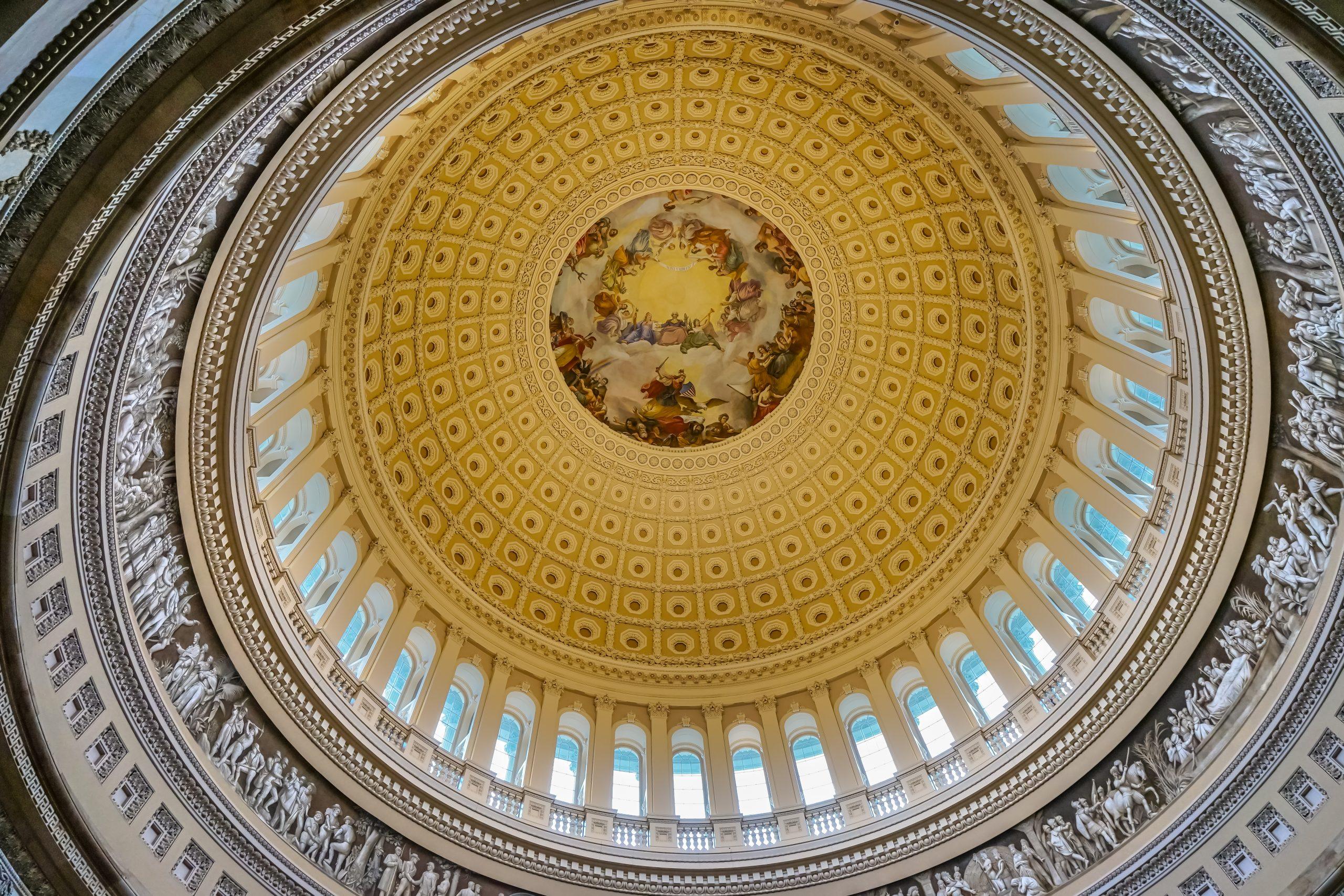

In May 2023, the European Union (EU) implemented the Clean Border Adjustment Mechanism (CBAM), a groundbreaking regulation to control embedded emissions in imported goods, including steel and iron.

CBAM requires importers in the EU to measure, monitor, and report greenhouse gas (GHG) emissions embedded in imported products. It will subject foreign manufacturers to the same emissions limits as domestic manufacturing within the European Union.

A wide array of manufacturing outside EU borders, including foreign producers of metal roofing, frames, vehicle parts, trains, pipes, nuts, bolts, etc. will all be impacted. Importers must accurately identify whether their imported products fall under the specific Combined Nomenclature (CN) codes, which are the EU’s version of HS (Harmonized System) codes for international trade classification.

The initial implementation of CBAM, in addition to steel and iron, requires cement, aluminum, fertilizers, and hydrogen imports to report emissions as well.

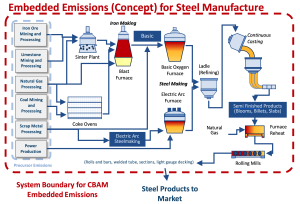

During the transition period of CBAM, which spans from October 2023 to December 2025, importers are required to report direct and indirect emissions resulting from the production of imported goods and the production of input materials (precursors). Detailed reporting is specified for steel and iron, covering, among others, fuel combustion, reduction of iron and steel by reducing agents, from the thermal decomposition of carbonate raw materials, heating, and cooling.

Direct emissions must be correctly attributed to imported products; importers should also report quantities of raw or semi-finished material inputs and determine embedded emissions of these precursors (see Figure 1). The regulation also recommends that foreign manufacturing facilities voluntarily have their emissions data and embedded emissions data verified by independent verifiers.

From 2026 onwards, if a carbon price has been paid by the foreign manufacturer in a foreign country, for producing goods and precursors, it may lead to a reduction in CBAM prices. During the transitional phase, information on foreign carbon taxes must be reported by the importer, so the European Commission can analyze the data and avoid double taxation as CBAM enters the definitive period in 2026.

If no information is reported, it will be assumed that there were no carbon taxes on the goods and precursors in their country of origin.

Leveling the Playing Field and Addressing Carbon Leakage

The EU’s Emissions Trading Scheme (ETS) was the world’s first emissions trading program, and it has resulted in approximately a 35% reduction in emissions within the EU since 2005. However, it only tells a partial story. The full story is that many industries fled ETS’s regulatory requirements and set up shop outside EU borders – and they continued to manufacture and export to the EU without reducing their emissions and without penalty.

Thus, manufacturing facilities in countries with lax environmental regulations gained an advantage over EU industries that were subject to more stringent GHG-reduction requirements.

To prevent this carbon leakage, the EU had initially relied on free ETS allowances for industries deemed at risk of flight. However, critics argued that this approach compromised the goals and principles of the EU ETS and failed to reduce the carbon intensity (CI) of foreign manufacturing. In fact, Europe became the largest importer of CO2 emissions embedded in imported goods, a major obstacle to becoming a carbon-neutral continent by 2050. CBAM attempts to fix this problem and level the playing field between domestic and foreign manufacturing with respect to emissions.

CBAM Complexities and Timeline

The CBAM system tries to mirror the EU ETS.

Starting in 2026, importers will be required to purchase CBAM certificates for the embedded carbon in steel imports that are above the limits set by the rules less any carbon price was paid in the country of origin. The price of a CBAM certificate will be based on the weekly average price of the EU ETS allowance. An independent accredited verifier must verify the reported emission’s accuracy. By May 31, importers will surrender the purchased CBAM certificates and thus ensure all the steel and iron consumed in the EU has the same emissions from manufacturing.

Acknowledging the challenges associated with implementing such a complex rule, the EU is requiring importers to only report data in 2024 and 2025 without a requirement to purchase CBAM certificates. Steel and iron importers are required to submit their first reports by January 31, 2024.

During the reporting period, importers can use emissions calculations from foreign countries to report embedded emissions, but starting in 2026, the EU calculation methodology with its emissions factors must be used.

Unilateral Regulatory Globalization and CBAM Reach

CBAM exemplifies the EU’s approach to unilateral regulatory globalization, a concept that has been called The Brussel’s Effect. Instead of negotiated standards under treaties or international agreements, the EU uses its buying power to externalize its regulations beyond its borders through market mechanisms.

The CBAM regulation indirectly dictates how foreign producers must measure their emissions. While reporting requirements are binding for importers in the EU, the regulation also impacts operators in third countries, who are required to provide the importers with relevant emissions data. This impact on economic operators in third countries highlights the far-reaching effects of the EU’s climate policies.

CBAM also demonstrates how carbon markets are maturing and becoming globalized. It is not unusual for foreign producers to place an EU-specific quality or safety label on automobiles, electronics, or food that is being exported for European consumption, but it is a first for carbon emissions. CBAM will require an EU-specific “low-emissions” label on steel and iron. As more manufacturers across the globe comply with these rules, it will have a far-reaching effect on global steel supply chains.

As the CBAM enters into force, foreign steel and iron companies must navigate the complexity of the system and its timeline to ensure compliance. Understanding these key requirements and the depth of the regulation is crucial for exporters looking to participate in the EU markets.

For more information:

For more information:

For more information about CBAM or other EU climate policies and programs, please contact Urszula Szalkowska at uszalkowska@ecoengineers.us.

Urszula Szalkowska is based in Poland and is the managing director and senior consultant, Europe for EcoEngineers.