National Petroleum Council Report Highlights Hydrogen’s Critical Role

By Tanya Peacock, EcoEngineers

As part of a diverse group of experts who participated in the study that provided the data for the National Petroleum Council (NPC) hydrogen report, I’ve gained a few insights and opinions on the report’s findings and what will be required to ensure clean hydrogen emerges as a promising pathway toward decarbonization.

Clean hydrogen emerges as a key player among the myriad technologies vying for attention in the quest to achieve net-zero emissions by 2050. However, the clean hydrogen industry will need additional economic and policy incentives if it is to grow supply and demand to help reach this goal, according to the NPC report, titled “Harnessing Hydrogen: A Key Element of the U.S. Energy Future.”

The NPC assembled a team of more than 200 experts from more than 100 organizations, 70% of whom come from outside of the oil and gas industry, including myself. The study was conducted in partnership with the Massachusetts Institute of Technology (MIT) Energy Initiative and leveraged scenario-based modeling. The study generated unique insights due to the diverse perspectives of the study participants, many of whom, like me, have practical experience with clean energy project development.

Report’s Top Findings

The NPC report includes 19 findings and 23 recommendations that, if acted upon, would help drive the deployment of low carbon intensity (LCI) hydrogen at scale through the entire value chain, including production, storage, liquefaction, transportation, and end uses. The top finding is the need for an economy-wide explicit price on carbon.

READ MORE: Summary of the Production of Clean Hydrogen Credits Under Section 45V of the Internal Revenue Code

The second and third findings are a national low-carbon-intensity industry standard and a national low-carbon-intensity transportation standard. The diversity of organizations – from oil and gas to environmental non-profits – that came together to agree on these recommendations for putting a price on embedded carbon was both surprising and inspiring, and a marked difference from the Low Carbon Fuel Standard (LCFS) implementation process in the late 2000s and early 2010s. “Harnessing Hydrogen” shows our evolving understanding of the need for market-based programs to support carbon reductions and economic prosperity in a carbon-constrained world.

Increased Policy Support Needed to Scale Clean Hydrogen

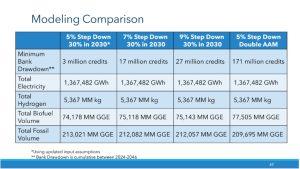

Central to the NPC report’s findings is how important it is to secure additional federal support to reach levels required to achieve net-zero U.S. carbon emissions by 2050. Current federal policies, including the IRA Section 45V clean hydrogen tax credit under the Inflation Reduction Act (IRA) and hydrogen hubs funded by the 2021 Bipartisan Infrastructure Law, would roughly double annual hydrogen production and demand by 2050 from about 11 million metric tonnes per year in 2021, according to the NPC report.

–National Petroleum Council, “Harnessing Hydrogen: A Key Element of the U.S. Energy Future”

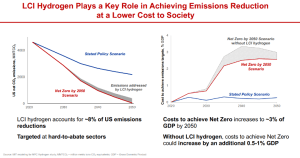

While the NPC report finds that low-carbon intensity (LCI) hydrogen could abate about 8% of U.S. carbon emissions by 2050 at a lower cost than non-hydrogen alternatives, it’s obvious that significant and immediate actions beyond current policies are needed. To achieve this goal, clean hydrogen demand would need to increase sevenfold from 2021 levels to 75 million metric tons per year to enable a cost-effective path to net zero in the U.S. by 2050.

To spur production-side incentives of LCI hydrogen, the NPC recommends Congress adjust the IRA Section 45V clean hydrogen tax credits by extending the credit-claiming period to 20 years to match the incentive more closely with asset life cycles and advocates for greater utilization of Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model capabilities, including co-product allocation and the use of verifiable values for life-cycle analysis (LCA). The NPC, however, did not weigh in on IRA Section 45V’s contentious method to account for the emissions of hydrogen made from grid electricity.

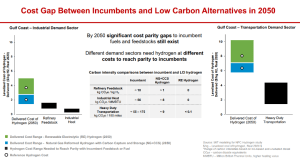

Shrinking the Cost Gap of Clean Hydrogen

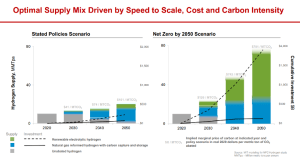

To reach net-zero carbon emissions by 2050, delivering LCI hydrogen at scale will require an evolving split between hydrogen from two key production pathways: fossil natural gas reformed hydrogen—or “blue” hydrogen—with carbon capture and storage (CCS) and renewable electrolytic hydrogen—or “green” hydrogen.

A cumulative capital investment of US$1.8 trillion will be needed to scale green hydrogen between now and 2050. To put this into perspective, green hydrogen production would require installed electrolyzer capacity to grow at a compound annual growth rate of 27% over the next 25 years.

–National Petroleum Council, “Harnessing Hydrogen: A Key Element of the U.S. Energy Future”

“While the required investment and growth rate to reach net zero supported by LCI hydrogen is formidable, it is comparable to the North American capital investment in upstream oil and gas ($1.9 trillion) and solar installation (30% compound annual growth rate) in the last decade,” states the NPC report.

Meanwhile, blue hydrogen coupled with carbon capture will require $100 billion in investments between now and 2050 to accomplish the same.

LCI hydrogen production will initially be driven by natural gas with CCS due to lower-cost feedstock availability and the ability to rapidly scale production, according to the NPC report, as it can provide the initial large-scale production needed to support dependable LCI hydrogen supply to new and existing end users, thus helping establish the LCI hydrogen economy.

READ MORE: The U.S. Department of Energy’s H2Hubs Program: Accelerating the Clean Hydrogen Economy

To achieve net zero by 2050, the CI of the LCI hydrogen production mix will need to experience continued reductions over time. “As the U.S. economy moves toward net zero, the marginal cost of abatement will rise,” according to the NPC report. “Ultimately, the production mix in the [net-zero 2050] scenario will have a higher proportion of [green hydrogen] due to its lower carbon emissions, the projected higher future cost of carbon, and anticipated cost reductions for green hydrogen.”

–National Petroleum Council, “Harnessing Hydrogen: A Key Element of the U.S. Energy Future”

In summary, the NPC report underscores the necessity for substantial policy interventions and investment to scale LCI hydrogen and achieve net-zero carbon emissions by 2050. Stakeholders across a multitude of industries must collaborate to implement the report’s recommendations, such as adjusting the IRA Section 45V clean hydrogen tax credit and increasing federal support for LCI hydrogen production technologies. Now is the time for decisive action to build a robust clean hydrogen economy that can meet our ambitious climate goals.

For more information on the NPC’s findings in the report or Eco’s hydrogen services, please contact:

Tanya Peacock, Managing Director, California and Hydrogen | tpeacock@ecoengineers.us